42 math worksheets calculating sales tax

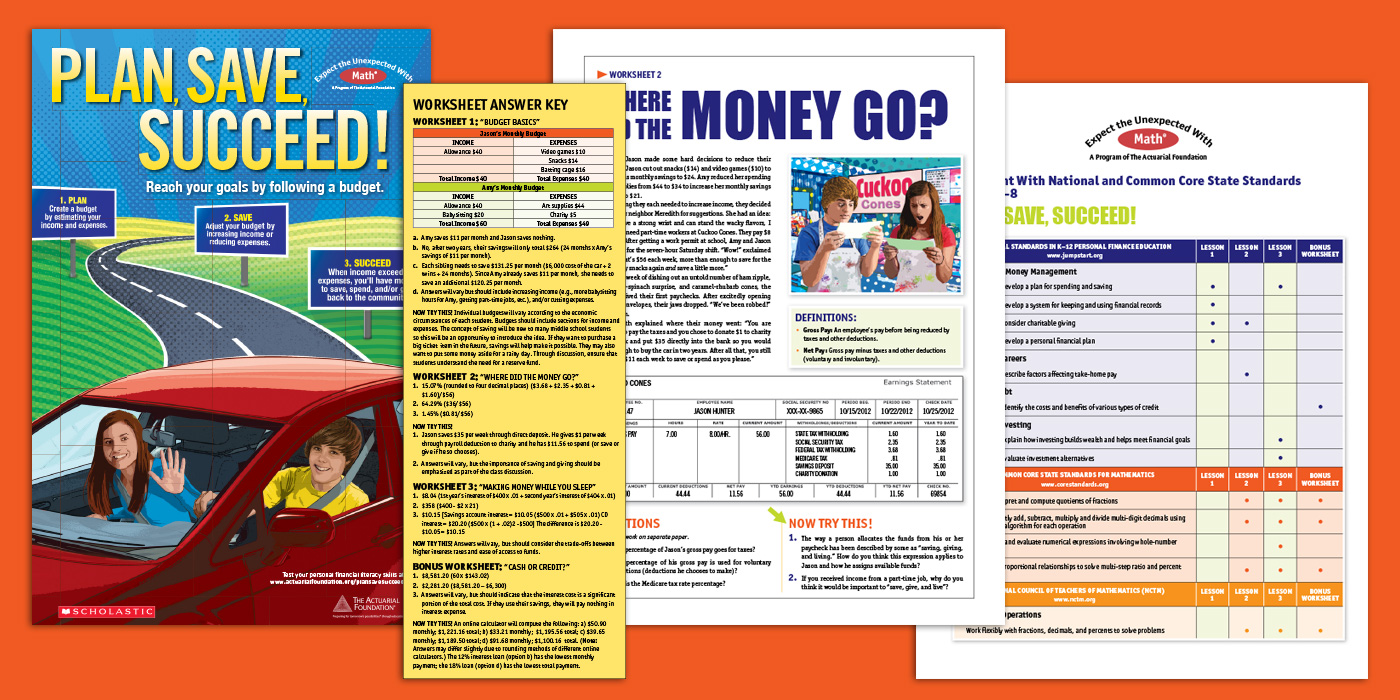

7th Grade Sales Tax Worksheets - Printable Worksheets Some of the worksheets displayed are Tax tip and discount word problems, Name period date tax tip and discount word problems, Personal financial literacy for grades 7 8, Markup discount and tax, Word problems involving discount, Practice word problems, Grade 7 math practice test, Scarf t shirt jeans sweater shorts 63 286. tech.msu.edu › about › guidelines-policiesAndrew File System Retirement - Technology at MSU Andrew File System (AFS) ended service on January 1, 2021. AFS was a file system and sharing platform that allowed users to access and distribute stored content. AFS was available at afs.msu.edu an…

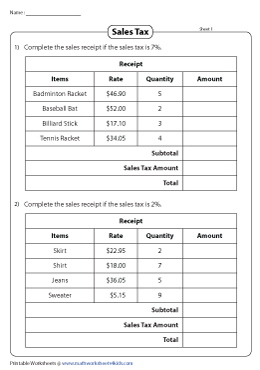

math sales tax worksheets - TeachersPayTeachers This product includes 12 worksheets. There are 12 questions on each worksheet, asking students what is the final price with sales tax? With a picture visual of what they are buying as well as the sales tax rate. This is a great functional reading / money skill to practice with students as they work on independent living skills.

Math worksheets calculating sales tax

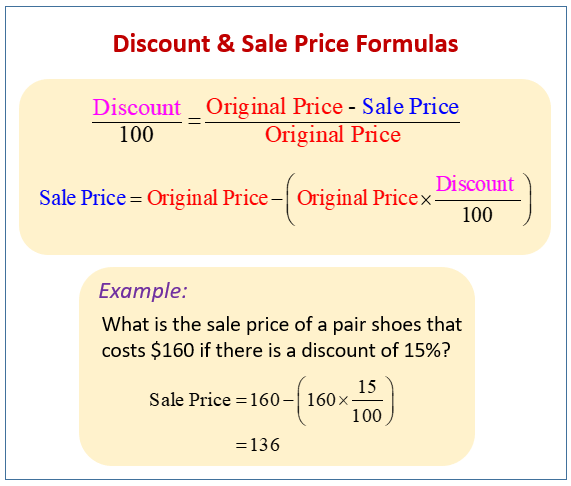

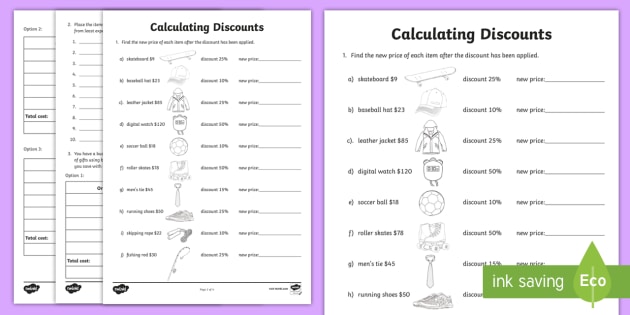

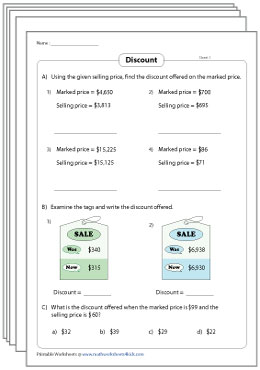

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects: Basic Operations, Decimals, Math Grades: 6th - 7th Types: Activities study.com › academy › lessonCalculating Performance Materiality & Tolerable Misstatements Dec 02, 2021 · As a member, you'll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed.

Math worksheets calculating sales tax. Sales Tax Worksheets - Learny Kids Sales Tax. Displaying top 8 worksheets found for - Sales Tax. Some of the worksheets for this concept are Sales tax practice work, Sales tax and discount work, Sales tax and discount work, Calculating sales tax, Sales tax and total purchase price version 2 answer keys, 2020 state and local general sales tax deduction work, Taxes tips and sales ... › counting-moneyMoney Worksheets Discount Worksheets. Cut away the chaos and introduce clarity with our pdf discount worksheets. Our well curated resources help students confidently practice applying all they know about discounts and discount percentages through scores of engaging exercises. Sales Tax Worksheets. Be future-ready with our exciting collection of sales tax ... PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax Practice Worksheet - MATH IN DEMAND Calculate Sales Tax Worksheets - Learny Kids Displaying top 8 worksheets found for - Calculate Sales Tax. Some of the worksheets for this concept are Calculating sales tax, Calculating sales tax, Tax and tip percent word problems, Scarf t shirt jeans sweater shorts 63 286, Sale price sales tax total cost, Work calculating marginal average taxes, Optional work for calculating call report applicable, Sales tax and total purchase price ...

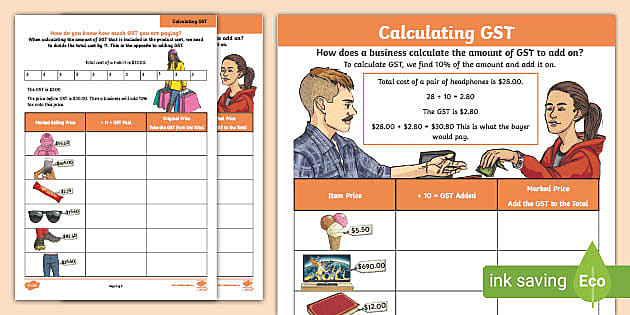

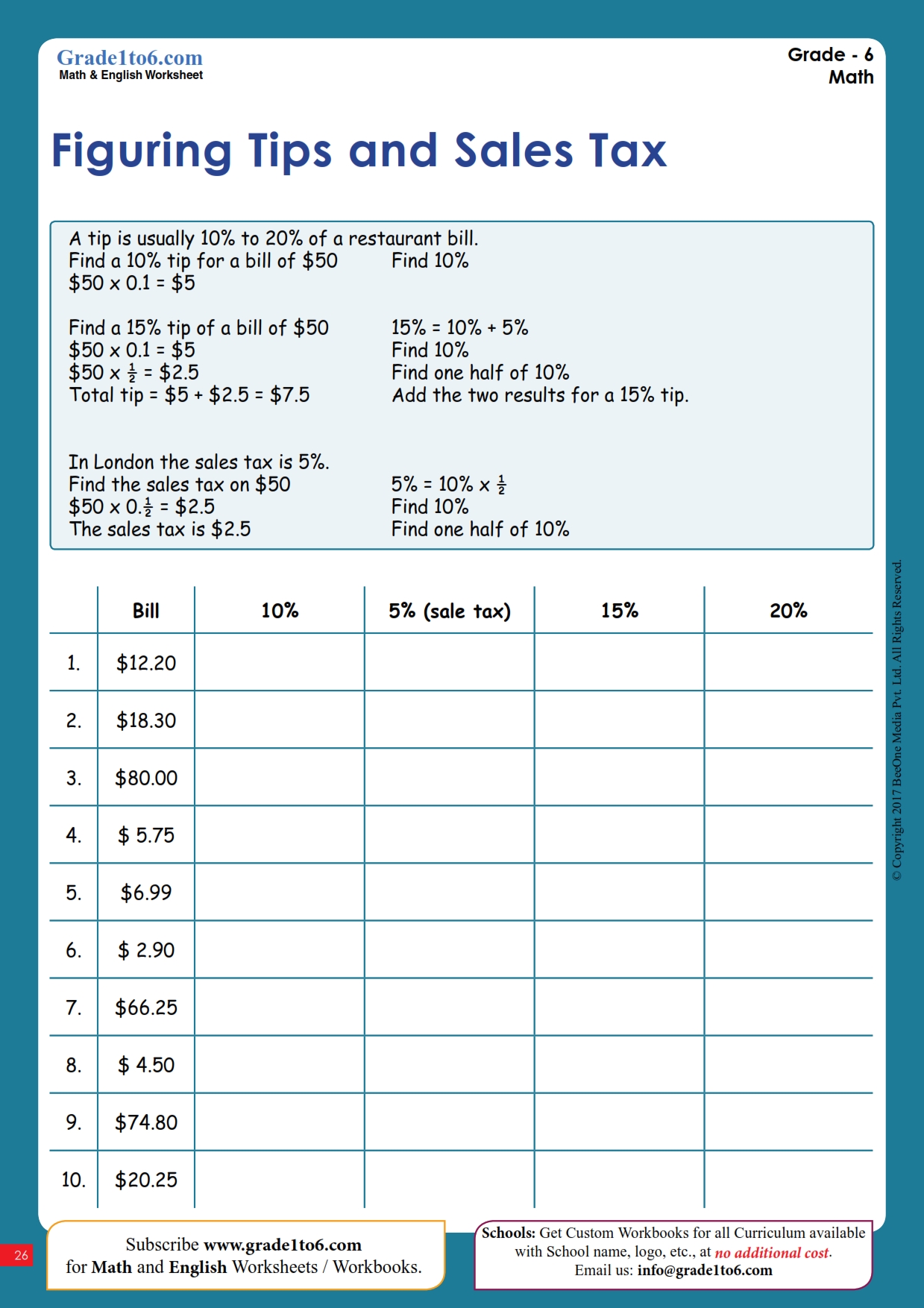

Calculating Tax And Tip Worksheets - K12 Workbook Calculating Tax And Tip Displaying all worksheets related to - Calculating Tax And Tip. Worksheets are Math tip work, Sales tax and discount work, Name period date tax tip and discount word problems, Tip and tax homework work, Name date practice tax tip and commission, Calculating sales tax, Markup discount and tax, Markup discount and tax harder. Consumer Math Worksheets The sales tax rate is 3 percent. What is the total purchase price, including sales tax? Unit Pricing and Comparisons 1 - You bought a two-liter container of cooking oil for $2.50. What is the cost per liter? Unit Pricing and Comparisons 2 - Martin purchased a 50-oz bottle of orange juice. If he paid $2.1 for the juice, what was the price per ounce? Calculate Sales Tax | Worksheet | Education.com Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost. Download Free Worksheet. How To Calculate Sales Tax: Formula To Use With an Example There are three steps you can follow to use the sales tax formula: Add up all sales taxes. Multiply by the sale price. Add the sales tax to the sale price. 1. Add up all the sales taxes To use this formula, you first need to add up all applicable sales taxes. Start by determining what the sales tax rate is in your state.

study.com › academy › lessonWork in Progress: Journal & Report - Study.com Dec 17, 2021 · As a member, you'll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed. Quiz & Worksheet - Calculating Sales Tax | Study.com Print Worksheet. 1. Which of the following is NOT a use for sales taxes? Health care funding. Education funding. Funding for roadwork. An office party. 2. Calculate the total sale amount of a ... Sales Tax Halloween Themed Math PDF Worksheets & Activities Download Sales Tax (Halloween Themed) Math Worksheets. This is a fantastic bundle which includes everything you need to finding Sales Tax across 18 in-depth pages. These are ready-to-use Common core aligned 6th to 7th Grade Math worksheets. Each ready to use worksheet collection includes 10 activities and an answer guide. Calculate Sales Tax Worksheets - Lesson Worksheets Worksheets are Calculating sales tax, Calculating sales tax, Tax and tip percent word problems, Scarf t shirt jeans sweater shorts 63 286, Sale price sales tax total cost, Work calculating marginal average taxes, Optional work for calculating call report applicable, Sales tax and total purchase price version 2 answer keys.

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

Calculating Sales Tax Worksheets - Printable Worksheets Calculating Sales Tax Showing top 8 worksheets in the category - Calculating Sales Tax. Some of the worksheets displayed are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts.

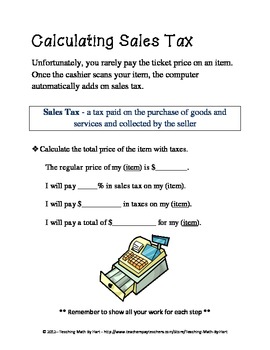

Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems.

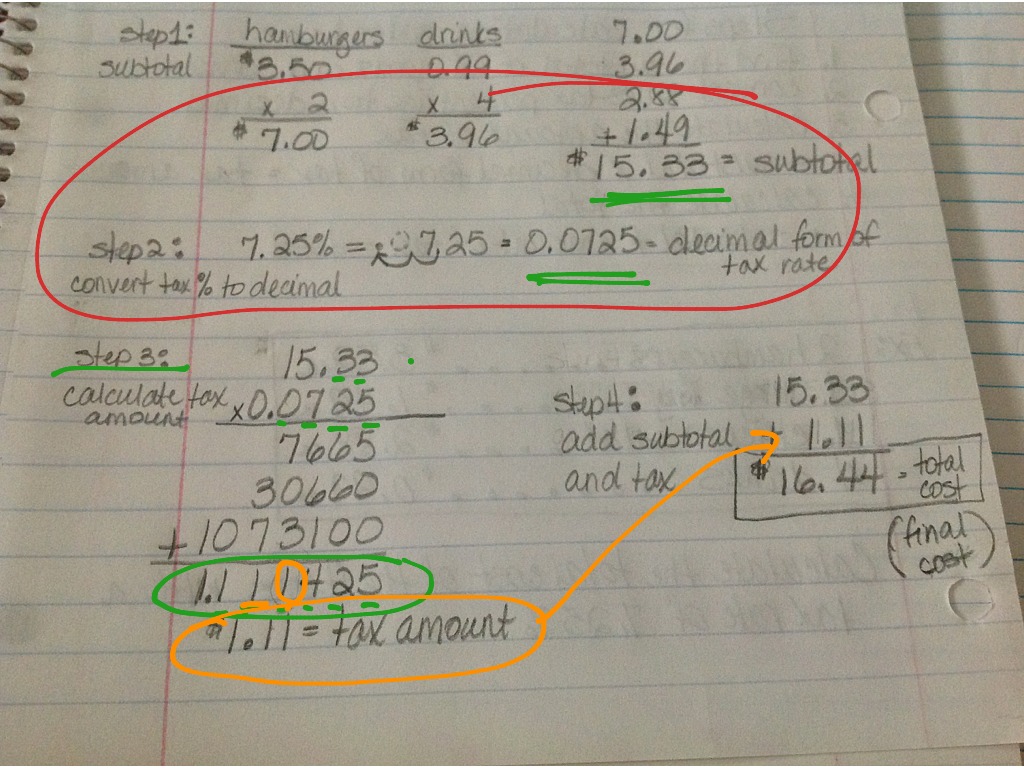

Sales tax - Math Given a price and a sales tax rate, there are several ways to compute the sale price. One method is to directly apply the sales tax by multiplying the sales tax rate (in fraction or decimal form) by the original price, then add the calculated amount to the original price. Example Joseph bought a large chocolate chip cookie that costs $2.00.

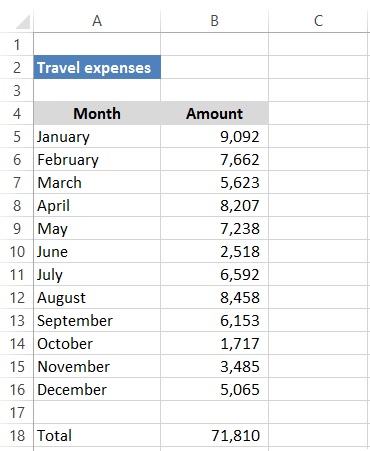

Sales Tax Calculator The price of the coffee maker is $70 and your state sales tax is 6.5%. List price is $90 and tax percentage is 6.5%. Divide tax percentage by 100: 6.5 / 100 = 0.065. Multiply price by decimal tax rate: 70 * 0.065 = 4.55. You will pay $4.55 in tax on a $70 item. Add tax to list price to get total price: 70 + 4.55 = $74.55.

How to calculate taxes and discounts - Cuemath Then, the rate of tax paid on that mobile can be calculated by using the above formula. Tax rate = (Tax amount/Price before tax) × 100. Tax rate = ($20/$200) × 100. Tax rate = 10%. Let's now try and understand how taxes are levied on a discounted product. Discount is calculated on the selling price, excluding taxes.

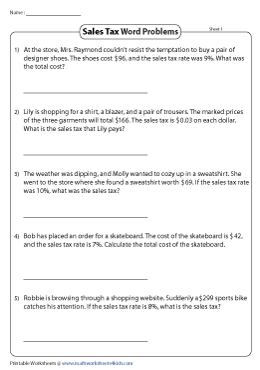

Sales Tax Discount and Tip Worksheet - onlinemath4all Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. Problem 3 : The dinner check for Mr. David's family is $70. If a tip of 15% is paid, How much total money should Mr. David pay ? Problem 4 : If the sales tax rate is 6%, find price of the shirt after sales tax on a shirt that costs $30. Problem 5 :

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 26, 2022 · It allocates tax revenues to zero-emission vehicle purchase incentives, vehicle charging stations, and wildfire prevention. The fiscal impact is increased state tax revenue ranging from $3.5 billion to $5 billion annually, with the new funding used to support zero-emission vehicle programs and wildfire response and prevention activities.

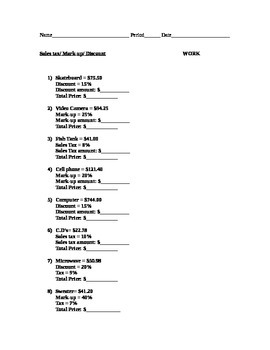

Sales Tax And Discount Worksheets - K12 Workbook Worksheets are Sales tax and discount work, Sales tax and discount work, Sales tax practice work, Discount tax and tip, Discount markup and sales tax, How to calculate discount and sales tax how much does that, Taxes tips and sales, Percent word problems tax tip discount. *Click on Open button to open and print to worksheet. 1.

› workbooks › fifth-gradeBrowse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! 5th grade

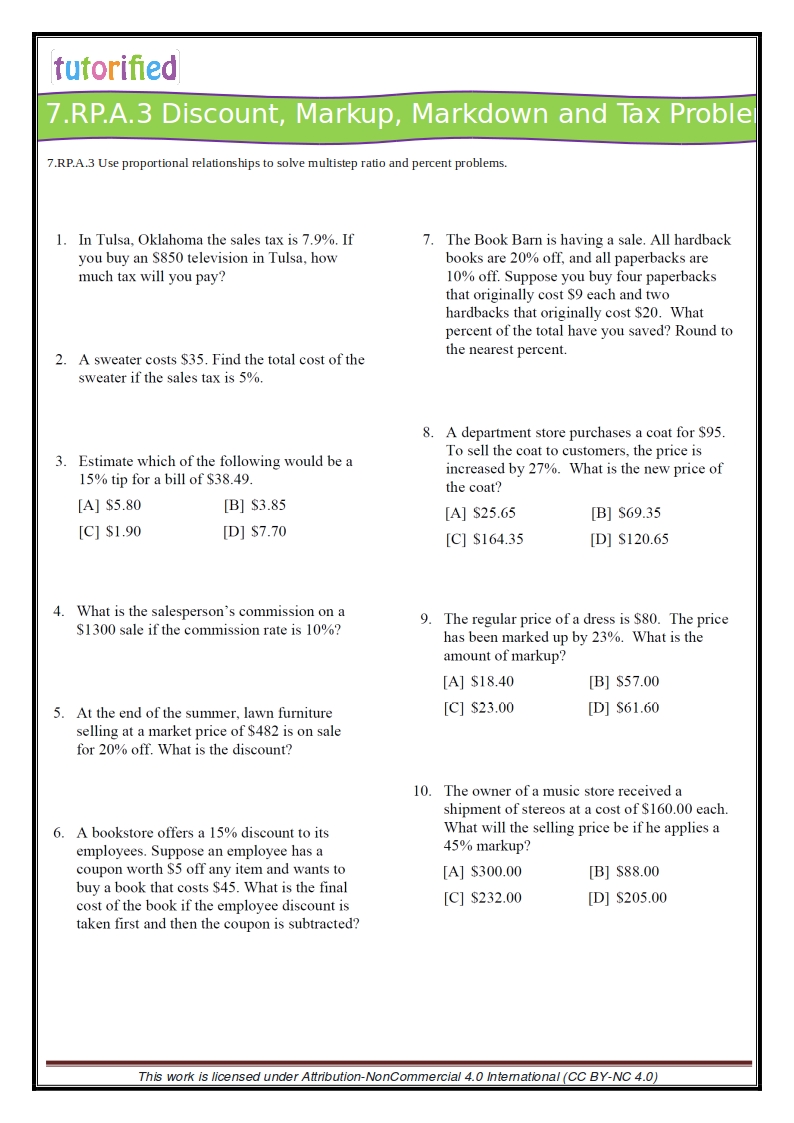

Markup, discount, and tax - Math Worksheet x 155 = 12 100 Now, cross multiply. x ∙ 100 = 12 ∙ 155 100 x = 1860 x = 18.6 18.6 is 12% of 155. Example 2: Let's try another. 9 is what percent of 215? 9 will be our "IS", 215 is our "OF" and we are looking for our percent. 9 215 = x 100 9 ∙ 100 = x ∙ 215 900 = 215 x x = 4.19 Now let's apply this to shopping and figuring out discounts and taxes.

Worksheet on Sales Tax and Value-added Tax - Math Only Math Practice the questions given in the worksheet on sales tax and value-added tax. 1. (i) A shopkeeper buys an article from the wholesaler at $ 72 and pays sales tax at the rate of 10%. The shopkeeper fixes the price of the article at $ 90 and charge sales tax at 10% from the consumer. Apply VAT system of sales tax to calculate the following.

Calculating Total Cost after Sales Tax worksheet Calculating Total Cost after Sales Tax Finding Sales Tax and Total Cost after it is applied. ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (38) Download file pdf Embed in my website or blog Add to Google Classroom Add to Microsoft Teams

Free Step-by-Step Sales Tax Lesson with Interactive Exercises | Math ... If we divide the sales tax by the price of the item, we get the sales tax rate. Solution: $17.68 - $17.00 = $0.68 and ($0.68) ÷ ($17.00) = 0.04. Answer: The sales tax rate is 4%. Summary: Sales tax is a tax on goods and services purchased and is normally a percentage added to the buyer's cost. Exercises

Calculating Sales Tax Worksheets - Lesson Worksheets Displaying all worksheets related to - Calculating Sales Tax. Worksheets are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts. Click on pop-out icon or print icon to worksheet to print or download.

How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems Discount = = Multiply the regular price by the rate of discount Selling price = = original price - - discount Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

› playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

study.com › academy › lessonCalculating Performance Materiality & Tolerable Misstatements Dec 02, 2021 · As a member, you'll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed.

Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects: Basic Operations, Decimals, Math Grades: 6th - 7th Types: Activities

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets.

0 Response to "42 math worksheets calculating sales tax"

Post a Comment